Russia is promoting the idea of BRICS Pay international payment system designed for use by BRICS countries exclusively as a replacement for existing global financial systems dominated by the West. While the original BRICS countries include Brazil, Russia, India, China, and South Africa, some of the newer additions are Egypt, Ethiopia, Iran, and the UAE.

What might motivate Russia to encourage the establishment of BRICS Pay?

For years, Russia has been calling for a financial structure independent of institutionally Western-backed institutions such as the International Monetary Fund and the World Bank, which it asserts do not act in the best interest of BRICS nations. This became another reason to look for an independent system that would exclude any chance of financial isolation after the West imposed harsh economic sanctions following Russia’s 2022 invasion of Ukraine.

Russia’s Finance Minister, Anton Siluanov, needed a BRICS-based alternative since the Western institution is unable to cater to the needs of the BRICS members who collectively represent close to 37% of the global economy. The proposal is building new institutions along but on parallel lines to the Bretton Woods system which will be aligned with the interests of BRICS nations.

How Would BRICS Pay Work?

BRICS Pay would leverage already existing financial infrastructures in the concerned countries; for instance, the Russian Mir payment network, the Unified Payment Interface existing in India, and so on. BRICS Pay would apply blockchain to validate and secure transactions. Hence, it could do cross-border payment faster and cheaper without interference from external factors. Users could convert their local currencies into the ruble, rupee, or real of Brazil, thus streamlining trade and commerce between members.

BRICS Pay, by various accounts, is to be the SWIFT system of Europe, smoothing out international transactions. It would also serve to de-dollarise transactions since the BRICS countries would be able to settle their transactions in their native currencies instead of relying on the US dollar.

A Step Forward in De-Dollarisation?

Russia and China have been embracing policies that seek to minimize the dominance of the US dollar in international transactions: a trend which is simply referred to as de-dollarisation. In 2022, the US dollar accounted for around 58% of all payments across international borders, except in the Eurozone. It is a testament to the power wielded by the US dollar in the global financial arena. BRICS Pay is part and parcel of Russia’s and China’s schemes toward weaning themselves off dollar dependence and establishing standalone financial systems.

Russia has also legalized the use of digital assets for cross-border payments and is working on creating two national digital asset exchanges. It reflects a broader aim to build a financial infrastructure less vulnerable to Western sanctions.

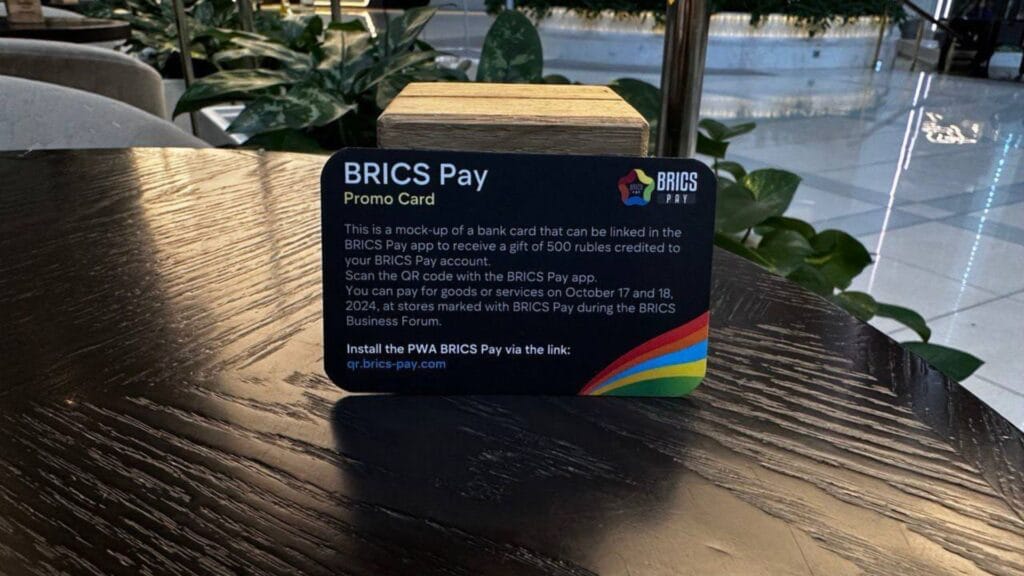

💳 PARTICIPANTS OF THE BRICS BUSINESS FORUM CAN NOW TRY A DEMO VERSION OF THE NEW PAYMENT SYSTEM – BRICS PAY

The card already has 500 rubles ($5.13), which can be spent during the forum on October 17-18 in stores with special BRICS Pay markings.

To activate the money, you need… pic.twitter.com/rZWK20PHLG

— Sputnik (@SputnikInt) October 17, 2024Benefits and Challenges

The proponents of BRICS Pay argue that a system of this nature would have huge benefits. This would include significantly reduced costs and speeds of processing. There would be no correspondent banks or compliance checks for these BRICS nations, which would possibly bring BRICS members up to $15 billion in savings per annum if half of their cross-border transfers adopt this model.

Challenges do exist, however. Even though Russia’s central bank has been pushing for the concept of a BRICS Bridge system meant to connect member states’ financial systems, progress has been slow. Developing a decentralized payment platform that will protect against the threat of external political will is no easy task; it will require a concerted legislative effort and interoperability that works across all the digital currencies used by BRICS members.

A Long Road Ahead

BRICS Pay is still in its infancy developmental stage, but it is a big step toward true financial independence for BRICS countries. A blockchain-based system, if successful, would change all notions about international trade among BRICS countries and would be a shaker in the dominance of the US dollar in terms of international trade. Only time will tell if it will eventually outsmart all the hindrances that go with implementation and become a game-changer in the global financial landscape.

The proposed system might represent a major stride toward a global financial order in which fiat money is decentralized and, therefore equitable to all participants.

Challenges To De-Dollarisation and Possible US Objections

In the context above, the concept of de-dollarisation is pretty attractive for the BRICS; however, the process will not come easy. One of the bases of American influence around the world is the dominance of the dollar, and it is unlikely that the United States is going to sit idly by while every nation strives to reduce its monetary muscle.

America has traditionally been willing to defend its economic interests, either through clandestine operations or geopolitical gamesmanship. To create instability between BRICS member countries may also be the case with the U.S. by encouraging tension between India and Pakistan or by provoking riots in neighboring Bangladesh, for example. Speculations of more extreme kinds are when the U.S. would even resort to a global level of conflict to ensure that the dollar goes on top and never loses its position as the reserve currency of the world.

Since all these remain speculative, they entail more complexities and challenges that BRICS faces in opting to shape its strategy for the decentralized financial system.

Minutes by M31GlobalNews